By Georgina Ainscow, Partner and Dr Xiaoxi Zhu, Assistant at intellectual property law firm, Reddie & Grose. Views are the writers’ own and do not represent those from the REA.

Assisted by 55% growth in wind power capacity worldwide between 2020 and 2021, wind energy is eclipsing the growth of all other renewable power technologies. Despite a drop in installed new capacity in 2022, wind power generation still increased by a record amount. As a result, the industry remains on track to supply more than one-third of total electricity demand by 2050, but much faster growth is required to meet the demands of Net Zero.

China dominates the other global players, with a 40% share in wind generation growth in 2022, followed by the US at 22%. China’s large land mass and long coastline is an exceptional resource for wind generation. The Gansu Wind Farm Project alone, found in gusty desert regions outside the city of Jiuquan, accounts for one-seventh of the country’s capacity with a total reserve of 200 million kilowatts.

The EU contributed 13GW of new capacity in 2022, responsive to targets set out in REPowerEU and the Green Deal Industrial Plan. In the US, too, policy incentives in the form of the Inflation Reduction Act continue to encourage new growth in the sector.

Of the total worldwide installed capacity in 2022, 93% were onshore systems, with the remaining 7% offshore wind farms. Unprecedented, however, is the fast development of offshore technology, with a record high 22% growth in total wind capacity in 2021, followed by 2022 remaining the second highest year ever. Despite this, offshore technology is still only present in 20 countries compared to 115 countries globally that are active with onshore, but expansion is expected in the coming years.

Global offshore wind energy in 2021 had a record year for deployment with over 17 thousand megawatts in new projects commissioned. This growth was largely attributed to China, which commissioned nearly 14 thousand megawatts more capacity in one year than the rest of the world has installed in any single previous year. The UK had the next largest annual deployment of offshore wind, contributing 3GW of capacity in 2022, with nearly 2,600 wind turbines across 39 offshore windfarms off the coast of England, Scotland and Wales, contributing to 13% of the UK’s electricity needs.

Despite the clear signs of growth, Net Zero success relies on 8 million megawatts wind power capacity by 2030, equal to doubling 2020’s record growth in average annual capacity. Quite aside from soaring costs and supply chain issues facing the wind industry, a global push to accelerate innovation is needed. Bigger turbines with higher power ratings are needed, as are solutions for either anchoring or floating offshore energy.

A greater obstacle will be overcoming the variability issue with research into low-speed turbines and energy storage. These questions will be answered by R&D investment and with innovation, a strategy for intellectual property protection must follow. Patents provide commercial reward when technology is ultimately deployed, and patent filing trends provide a useful lens to view the direction of innovation in wind energy.

WIND ENERGY: PATENT FILING TRENDS PUBLISHED PATENT FINDINGS

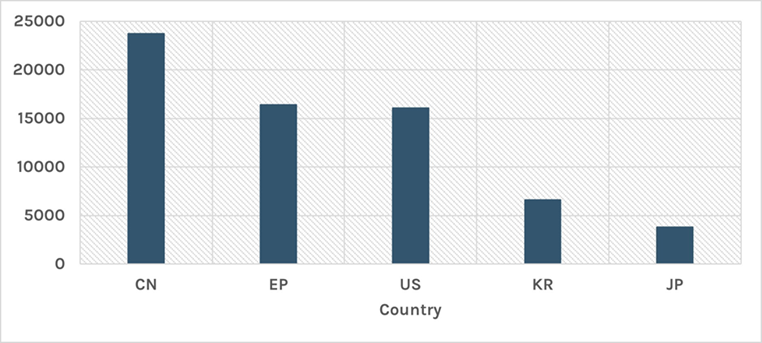

By region, China, again, ranks first in the statistics (Figure 2), reflecting their large share in wind generation growth. Following China is Europe – which in this context covers the EU countries and notable others including the UK, Switzerland and Norway – then the US, Korea and Japan.

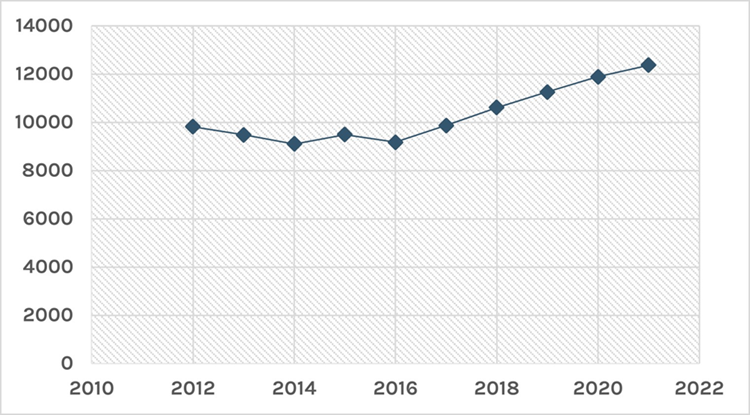

Figure 1 – global patent filing numbers within the recent 10 years (2012 to 2021)

PUBLISHED PATENT FINDINGS

Figure 2 – patent filing numbers by regions within the last 10 years (2012-2021)

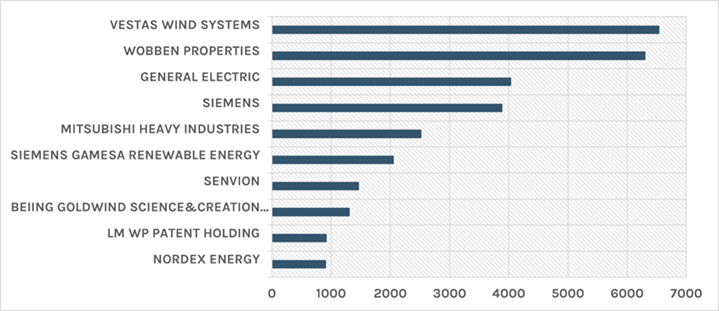

Patent trend analysis in this space also shows a clear correlation between patents and commercial success, with the top 10 patent filers (Figure 3) largely overlapping with the top 10 wind turbine manufacturers as listed by BloombergNEF. These companies include Vestas, GE, Siemens Gamesa, Goldwind and Nordex – a key example being Denmark-based wind turbine company Vestas, which has the highest volume of patents filed and is also recognised as the world’s largest wind turbine manufacturer and supplier in 2022.

PUBLISHED PATENT FILINGS

Figure 3 – top 10 filers in wind energy within the recent 10 years (2012-2021)

According to BloombergNEF, the top 10 world’s largest wind turbine companies account for over 75% of the total global installed capacity every year. Their market success is irrefutably linked to a comprehensive patent strategy that protects innovation and ensures that their technology is desirable, and cannot be mimicked, when decisions are made on wind energy projects. Their dominance is expected to continue as their technology is utilised to meet the industry’s Net Zero targets.